Governing the Gateway to Defi

Nov 18, 2023

Before designing a governing framework for something that hasn’t been built before, it is worth taking some time to consider what that thing could become.

Before designing a governing framework for something that hasn’t been built before, it is worth taking some time to consider what that thing could become. The forces that will develop interests in the thing as it grows should be identified early, and perhaps included in the initial framework. This is not only to keep a balance of power, but to ensure incentives will exist for the right forces to drive the thing to it’s highest potential. Infinex needs a governing framework, and so we should take some time to discuss what Infinex is poised to become.

In the immediate term, Infinex will serve as a CeFi-like UX gateway between mainstream traders and decentralised perpetual futures. Over the longer term, however, the very same gateway can be used to usher the mainstream into far more than just decentralised trading.

A gateway to DeFi

A centralised exchange with product market fit in their trading product often moves to build a quasi-bank for it’s customers – a place to park, swap, and send spot assets, while also earning yield, borrowing, lending, and collateralising derivative positions. Similarly, once Infinex has nailed the UX gateway into decentralised derivatives, we will by the same token have a gateway into every other DeFi primitive – the UX layer for all of decentralised finance.

This is how composability becomes a practical competitive advantage over CeFi. If all of the passion and brainpower of builders on Ethereum can be channelled through a unified UX layer, that collective force will dominate the capability of any single centralised entity – the tortoise closes in on the hare. Governance over a project with a mission so far-reaching for the wider ecosystem will require coordination of a diverse range of voices.

Born from an ecosystem

Infinex will begin by connecting the world to decentralised derivatives trading via Synthetix PerpsV3. Infinex is a Synthetix ecosystem project at its core, and so the Synthetix community should be central to the governing framework that shapes Infinex.

It also means that interests between the two projects must aligned from the outset. It is for these reasons that Infinex will not launch with its own token. Instead, Infinex will propose a vampire attack on Synthetix governance, allocating a large slice of governing power to Synthetix stakers. More on that below.

Representing DeFi

Building the UX layer for DeFi will also require buy-in from the wider DeFi ecosystem. If we can embrace representation from traders in allied DeFi projects from day zero, the Infinex culture will be born out of unification rather than divisiveness. Our common goal, at the end of the day, is to eat into the CeFi marketshare, not to fight over crumbs. Achieving this without a native token at launch will require a little more creativity – more on that below too.

Building for the world

Assuming we have effectively allocated power to Synthetix and to the wider ecosystem, there’s still one camp of stakeholders left unaccounted for: the user. Although one would expect early adopters of Infinex to be DeFi natives, ultimately these are the builders, not the end-users. Infinex is coming for the CeFi market, and this can’t be achieved effectively without giving a voice to existing CeFi users.

That may sound challenging, even with a native token, but rest assured there is a plan – a considerable experiment in onchain governance.

Governance farming

The Infinex Mansion

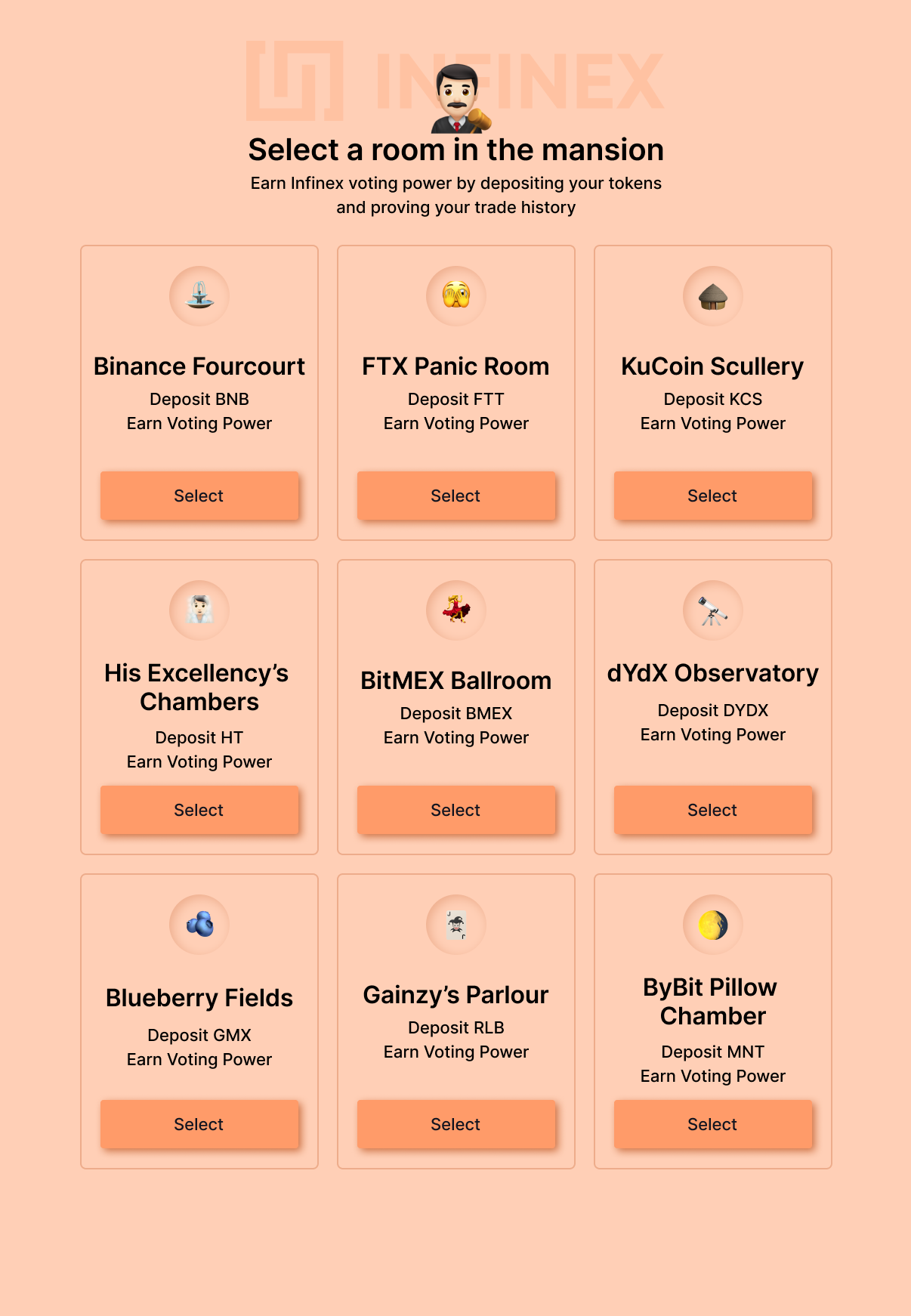

Nominations for the first Infinex council will open with the opportunity to earn a stake in the long-term governance of Infinex. Any trader from a centralised or decentralised exchange can earn governance power by connecting their wallet to the Infinex Mansion and choosing the most appropriate rooms to participate in.

Every room represents an exchange. Traders who have used that exchange in the past can farm Infinex governing power by:

- depositing the exchange’s native token, or

- connecting a read-only API key to verify their historical trading volume.

Industry allocated governance points (GP) will be calculated via the following formula:

$GP=Base Points×Time Weight=(aD+bV)×c÷(t+1)$

where:

$D=$ the dollar value of tokens deposited

$V=$ twelve month trading volume in dollars

$a=$ weight allocated to deposit value

$b=$ weight allocated to trading volume

$t=$ time since the opening of the Infinex Mansion

$c=$ weight allocated to time spent farming

Governance points will be distributed across the seven day nomination period. The earlier a trader begins farming, the more governance power they will be distributed.

The FTX voice is especially important in determining how to redesign CeFi and will therefore receive it’s own multiplier atop of staking a native token on another centralised exchange. FTX users who have since dumped their FTT can still participate by verifying their email address as a creditor to farm their own slice of governance power.

Synthetix stakers do not have to participate in governance farming, although ecosystem rooms may be deployed to boost voting power. Election contracts that count votes based on Synthetix weighted debt will give SNX stakers a piece of governing power without their opt-in (the aforementioned vampire attack).

Once nominations close, elections for the first Infinex council will immediately begin.

The Infinex Council

The Infinex council consists of five seats, and will govern the protocol and treasury as a single, unified council. However, different parties can vote for different seats in order to represent a specific voice, and not all elected members will have equal power in certain decisions.

Each councillor will receive a stipend in SNX tokens – the exact amount will be up for discussion (somewhere in the thousands of tokens per month).

One core contributor seat

Nominations for the core contributor seat are open only to those who hold an Infinex core contributor NFT, and will be voted on by Synthetix stakers. The core contributor seat is responsible for ensuring protocol integrity and managing Infinex core contributor resourcing.

Two ecosystem seats

The ecosystem seats will also be voted on by the Synthetix stakers, with nominations open to anyone. These councillors will represent the interests of the Synthetix community, connecting the interests of Infinex to the broader ecosystem and ensuring Infinex develops from a position of strength.

One treasury seat

Nominations for the treasury seat are open, and will be voted on solely by investors and financiers of Infinex. Outgoing transactions from the Infinex treasury will require 5/7 votes, of which the treasury seat has three, granting them veto power (without unilateral control) over the assets provided by financiers and investors to build Infinex.

One industry seat

The industry seat represents the interests of the trader, across the broader DeFi and CeFi ecosystem, excluding those from the Synthetix community. The industry councillor is voted in solely by participants in governance farming to establish diversity and unification in Infinex governance.

Additional considerations

It’s arguable that one industry seat is not enough to bring the requisite diversity to the council. An alternative approach would be to expand to a seven members council, adding one core contributor seat and one industry seat to the structure outlined above. This would give both CeFi and DeFi their own respective voice on how things are shaped.

However, a five-seat council will assist in moving the project quickly during the early days. These decisions can be hedged by making the owner of the governance module a separate debt-weighted voting contract, enabling upgrades by referendum-style vote by SNX stakers.

Next steps

This essay outlined a framework for how Infinex could be governed, and its rationale. However, this is only a proposal – ultimately it will be up to the Synthetix token holders to decide whether they want to be included in the governing of Infinex under this framework. Once discussions have been had and details refined, a token-weighted snapshot vote will be held to approve or deny the Infinex governing framework.

We’re entering a pivotal moment for the space, where strong leadership is needed more than ever. Infinex is calling for those leaders to help fulfil the promise DeFi: a decentralised financial system for the mainstream.

Back to What's new